In March of 2022 - Dan Mccormick texted this image to his brother Packy, a well known startup writer and creator of the Not Boring newsletter on his idea of selling creatine.

Over 2+ years later and Dan has grown an idea for a creatine gummy business to over 10+ million ARR.

Today I want to dive into how he’s built Create from the ground up. And what there is to learn if you’re starting your own consumer packaged goods brand.

Note: All of this is a collection of his public tweets - and you can obviously follow him for the live up-to-date progress on Create.

Create’s Core Thesis

Dan’s core thesis for Create comprised of three things:

The Creatine Market is Underserved: Historically creatine been associated with yoked gym bros. But actually creatine is great for almost every one including the normal workout every day gym workout guy and girl.

Creatine is Gross: The existing creatine brands are disgusting to consume.

Creatine Actually Works: Recent research papers have helped push creatine into the mainstream and become a well studied drug that helps with recovery, increasing muscle mass, and surprisingly also productivity and focus.

I’d argue there are probably better and long term market conditions that are also at play. An existing growing market of interest in supplements, Huberman, and health and wellness overall. But for something to succeed in a large growing market - you still have to carve out a niche.

Enter in the Create gummy, a tasty gummy filled with creatine rather than a bag of powder that you have to carry around in airports. And evidenced by this ad that Dan asked someone to create for $500, TSA will certainly scan your bag and run an extra check on your powdered goodies.

But the most important part is that supplements, including creatine, only work if you continue to take them over time. And so naturally it lends itself to a much stronger subscription business compared to the normal D2C e-commerce brand.

But there’s a lot of supplement businesses that exist as subscription businesses. So how did Dan succeed when others didn’t?

Getting the Initial Customers for TryCreate

Dan didn’t just come into D2C blind. He worked at two other e-commerce companies, Away and Parade, while also helping his brother write Not Boring before starting Create.

So by tweeting and having a constant presence on Twitter in the entrepreneurial and founders community - he had some existing customer base that was willing to try creatine.

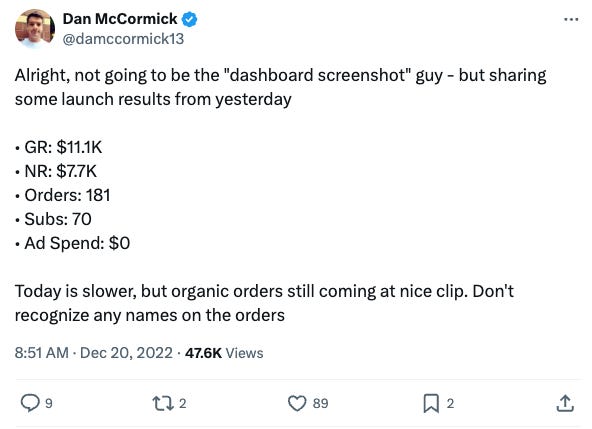

And so just 9 months later after texting Packy about the creatine idea - he launched to his Twitter audience in December of 2022. The initial post got over 100K+ views on Twitter detailing his launch of Create and his thesis for why. Along with a discount code for 20% off.

This strategy worked pretty well - he also gave away a first month package for free to startup founders and female wellness influencers that were in his target demographic of >25K followers. This strategy of a free order helped with pushing UGC content for the initial launch of Create.

The lesson is clear - having some sort of initial audience that you can sell to, no matter how big, is a great advantage. And pre-selling them through tweets beforehand is also a great way to see if the traction is there, conduct initial customer interviews, and iterate on the initial MVP.

Gaining Traction in the First 3 months

One month after launch, Dan posted the month one retention numbers for all customers that purchased subscription.

LTV (life time value) estimates were initially $360 for a blended 1 year long term rate. But by January 2024, Dan mentioned that 3 month retention was at $120 which indicates likely a lower LTV than $360 by then given how subscriptions can fall off.

But this number is still really good given that CAC for Dan for the first month in January 2023 was $35 and average order value was already $57. This means that Create was profitable on the first order. And by February 2023 blended CAC increased to $45 even though volume through Meta ads doubled and Create did $129K in net revenue.

How is Dan managing to do this while charging 5x to 10x the normal price for creatine?

It’s clear that Dan also raised money to make this happen to scale up revenue fast. Unlike SaaS where you get paid upfront for delivering a service that costs pennies on the dollar, CPG items require you to raise some amount of money upfront, whether from savings or an investor, to produce the item before launching it.

But the key insight here on the money raise is that most e-commerce brands have a higher execution risk but lower product risk → where if the product has strong unit economics on first three months of launch like Dan did - he can pave a path towards building a $50 million in ARR brand through strong execution of an existing D2C playbook.

Scaling Growth through Ads

By March of 2023, Dan had scaled up to $172K in revenue for the month.

Given the initial traction from the first month of retention, this proved reinvesting into growth was very achievable. For D2C businesses payback period is especially important because working capital determines how much you have. Gross margins determine what kind of return on ad spend you need as a minimum to be sustainable.

Keep reading with a 7-day free trial

Subscribe to The Data Stream to keep reading this post and get 7 days of free access to the full post archives.