Myth Busting and Expert Takes on the Real Estate Market

Why are homes so expensive and are prices ever going down?

A few months ago, after doing research into buying a ski home in Salt Lake City, I decided I wanted to take all my readings and concretely publish a piece on the current state of the real estate market and it’s insanity.

But after reading A LOT on the subject, with so many good takes coming out week after week, I’ve come to realize that I am probably not willing to put in the effort nor an expert enough (is anyone really?) to come to any accurate and broad conclusions hypothesis on the phenomenon that is the U.S. real estate market.

Instead I wanted to bust some incorrect themes that I’ve been seeing from Reddit and “cocktail party” type conversations, by providing links to relevant experts within the hyper-specific problem sets that real estate is in. And lastly I will add my own concerns on why I care about housing and real estate so much, because at least I can stand by my own opinions.

Quickly why I care about real estate

Real estate sits in the intersection between investment and necessary shelter. There are investment assets that have climbed more than the 20-30% YOY price that real estate has in the past few years such as GameStop instance or crypto. But you also cannot live in GameStop stock nor will the price of the stock affect your ability to continue to live in your existing community.

Basically everyone, everywhere feels like real estate is unaffordable. Even the people that have recently bought homes in this insane market have felt like it was unaffordable (maybe because of the relative price bias). The American dream is almost always to own rather than rent, but this may be an unattainable dream that we’ll have to give up soon.

Being a renter for so long, I’ve idealized homeownership. And this market is turning homeownership into something that cannot really be “tried out”. Rather you’re a renter forever and then when you decide to make the switch, likely a homeowner forever.

Throughout I’ll try to breakdown:

This market is insane.

Who’s buying all the homes?

Are AirBnBs and short term rentals causing this insanity?

Some expert opinions and articles to read.

Last thoughts.

A quick shout out to this article’s sponsor which is the Chase Sapphire Preferred card. Technically they are not a real sponsor but I get 15K points for every referral I make and right now the bonus on the card is 80,000 points! This is equivalent to $1000 in redemptions and it’s the highest the bonus has ever been. It is also literally free money now because Chase is allows you to redeem your points to pay back your credit card purchases at a $1.25 to 1 Chase point rate.

Please note that you won’t qualify for the bonus if you’ve opened the Chase Sapphire Preferred OR the Chase Sapphire Reserve in the last 4 years. So basically you have to had opened the card before May 2018 (if you’re reading this right when it’s released).

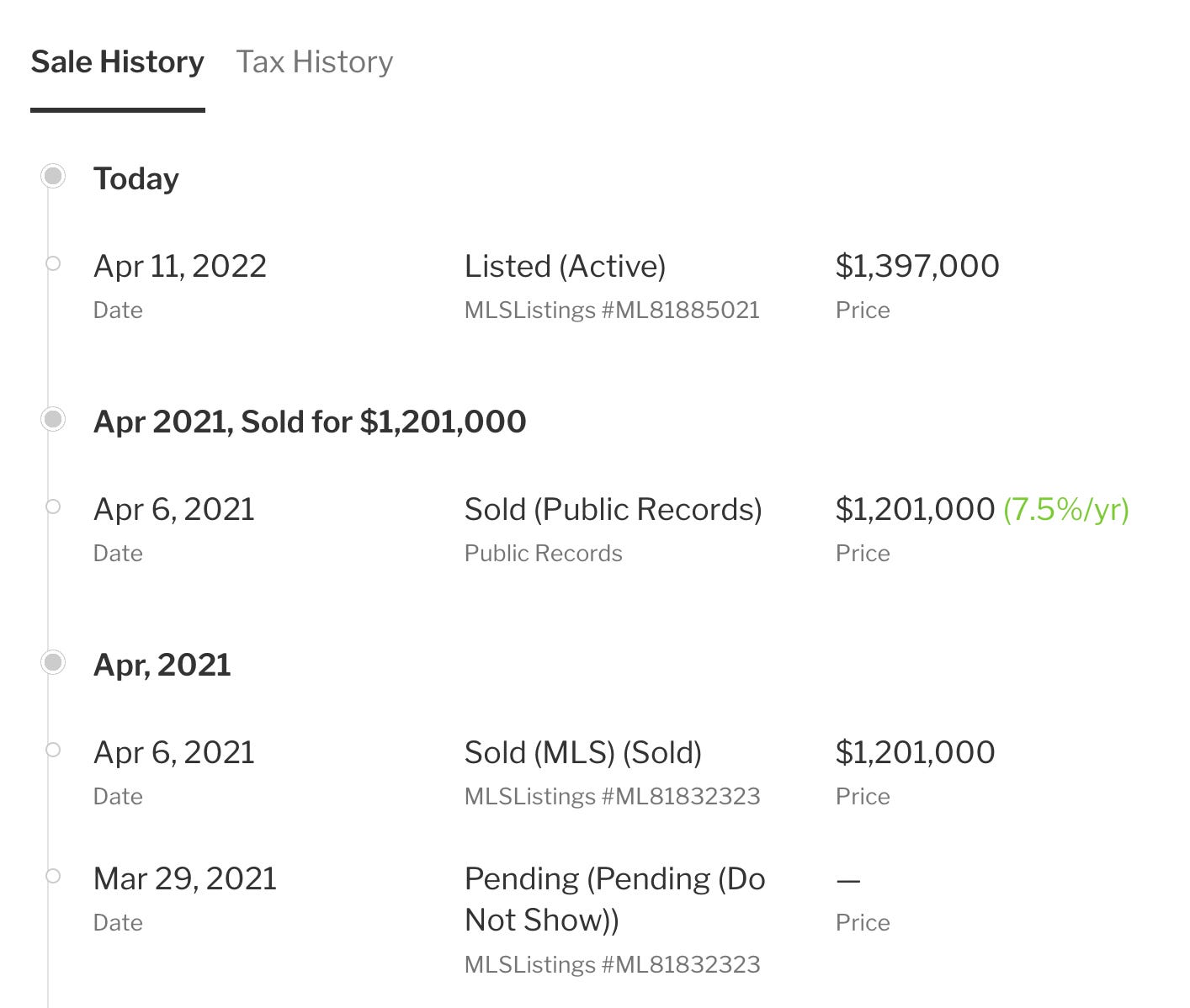

The market is insane

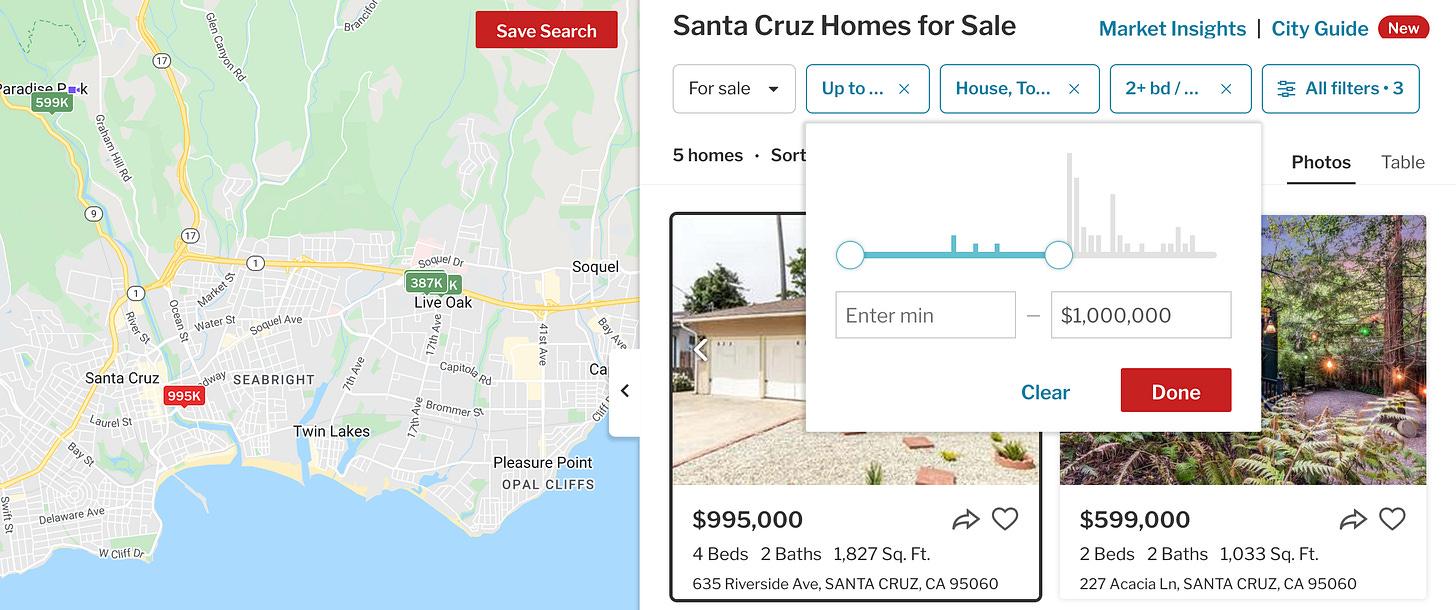

Here is an example of a typical home that was sold almost one year ago in Santa Cruz, CA.

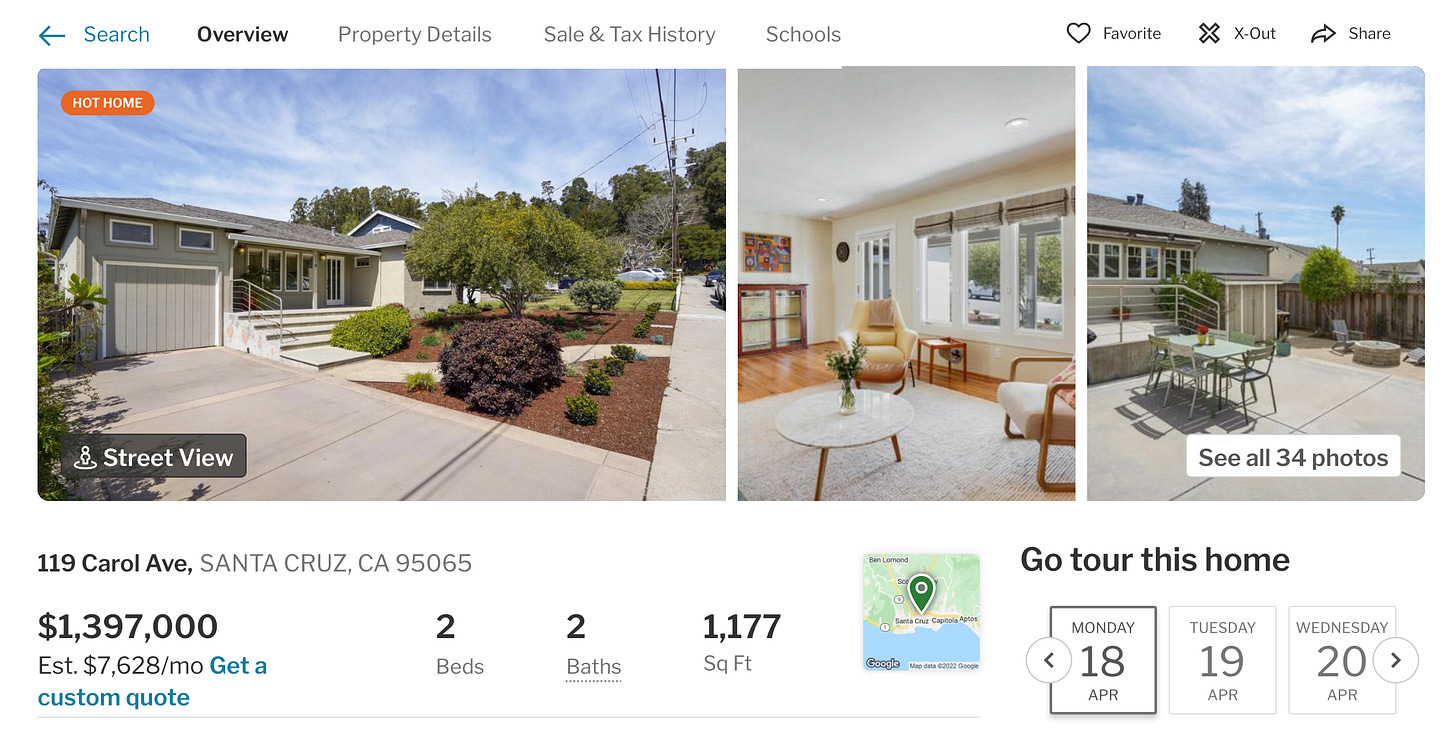

And exactly one year later - they are listing it for $200K more than they bought it for with almost no true alterations.

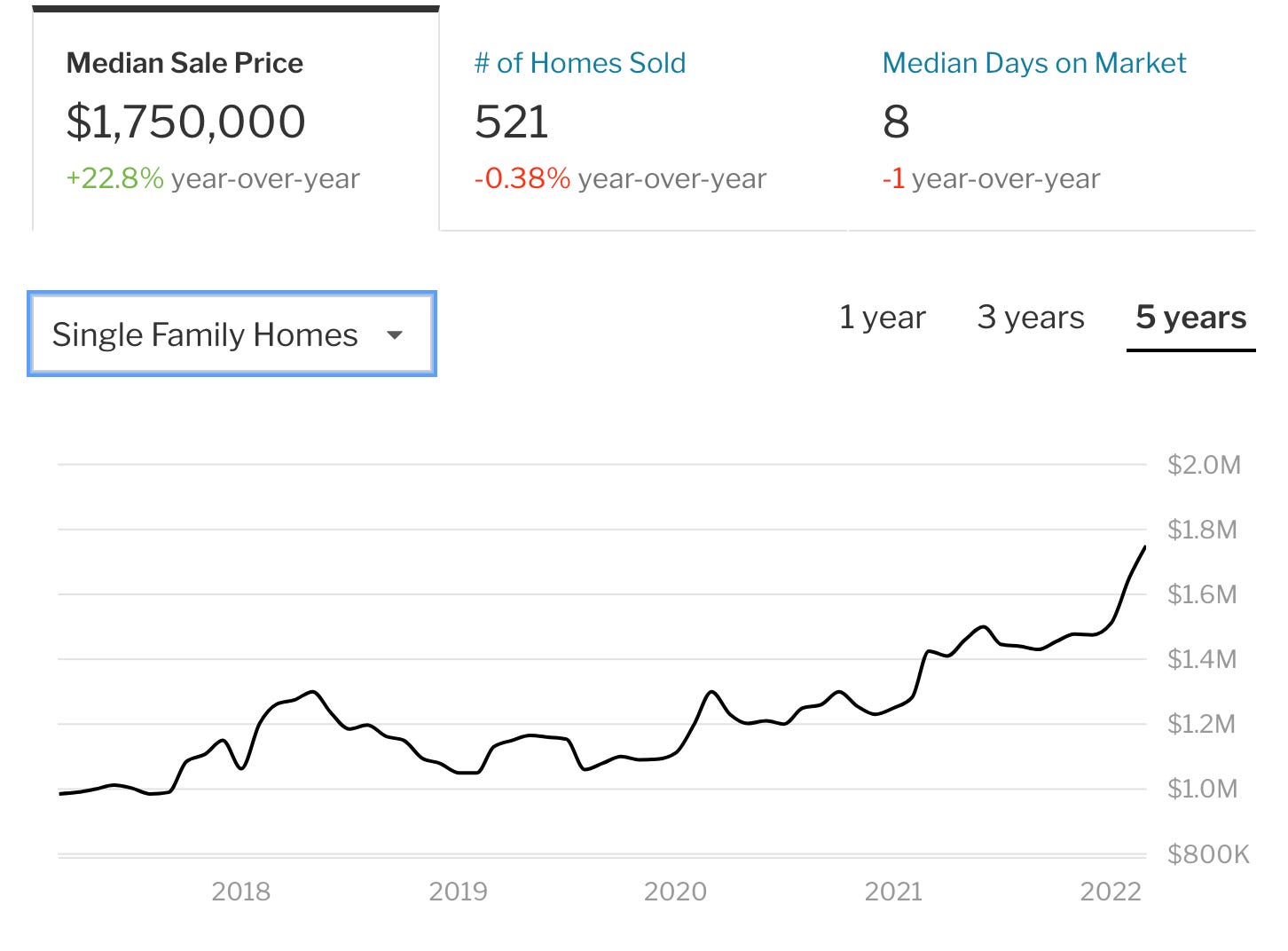

And if you’ve been paying attention to real estate this is not a surprise. There are thousands of these examples showing up every single day on the market. And specifically, it’s a sign of single family homes slowing moving away from being the primary home to a family of 4 to more brazenly becoming an investable asset class.

If I can buy a home and resell it in a year for a $200K gain, then I can pocket a 15% return if I bought it with cash, and an 75% return on my money if I had taken out a mortgage. (20% down on a 1.2 million dollar home is $240K. If they sell the home for 1.4 million then they’d profit around $150K to $180K after closing costs).

This begs to wonder if the rise of home prices is creating an asset class bubble full of speculators instead of actual homeowners. That being said it’s still much harder to get a loan now than it was in 2008.

Here are some stats on overall housing price growth. Home value growth in 2021 exceeded the median salaries in 25 of 38 major metros in the United States. For example San Jose has the highest median salary at $93,000 and led all major metros in annual home value appreciation with a whopping $229,277 over 2021. This meant the median American owning the most average home increased their net worth more by just living in their house than by putting in hours at work.

Given that fact - it’s no surprise that we are reaching the highest home price to median household income ratio in the last 70 years. While millennials always thought they were the first generation that could never afford a home, this is slowly becoming more and more of a true reality.

So who’s buying all these homes?

There does seem to be a large misunderstanding on who’s driving up the demand for homes. You see headlines like this:

Or titles where Wall Street Is Buying Starter Homes to Quietly Become America’s Landlord.

The big blame is coming towards corporations because it would make sense that buying and reselling homes as an asset has become profitable for corporations at scale. But if this analysis done by the Atlantic is correct, then it’s not private equity roll ups that’s making housing unaffordable.

The U.S. has roughly 140 million housing units, a broad category that includes mansions, tiny townhouses, and apartments of all sizes. Of those 140 million units, about 80 million are stand-alone single-family homes. Of those 80 million, about 15 million are rental properties. Of those 15 million single-family rentals, institutional investors own about 300,000; most of the rest are owned by individual landlords. Of that 300,000, BlackRock—largely through its investment in the real-estate rental company Invitation Homes—owns about 80,000. (To clear up a common confusion: The investment firm Blackstone established Invitation Homes, in which BlackRock, a separate investment firm, is now an investor. Don’t yell at me; I didn’t name them.)

That means that of the 15 million investor homes purchased, about 2% (300K homes) were purchased by institutional investors. Which means an estimated 98% of landlords are regular mom and pop shops, making being a landlord a largely small-business venture that politicians enforce as being the backbone of America.

Democratization of real estate as a passive income generation is also growing. The popularity of sites like BiggerPockets demonstrate that real estate cash flow investments can be a simple path towards financial freedom that anyone can make.

But maybe a larger issue is that large portions of the U.S. then believing that the rising cost of housing is caused by corporations owning single family homes.

Here’s one article theorizing how iBuying companies like Opendoor are selling straight to investors.

Some homeowners associations are also banning buyers from renting their homes for 2 years to stop the pace of investment. This in theory creates a more solidified community but overall decreases the supply of available rental housing, thereby increasing rents and pushing more people into buying housing prices again…

Are Short Term Rentals to Blame?

Short term rentals have also gotten a lot of hate recently. Here’s a Reddit post displaying all of the STR units in Seattle on a map, showing nearly 4000 units across the city boundaries.

But the commenters in the thread proved that 4000 is actually only 1-2% of the total available units on the housing market in Seattle. That small of a percentage also shows that short term rentals do provide an actual need towards housing temporary workers and visitors that can’t be filled by hotels.

But that’s not to say that AirBnbs are not affecting housing by becoming a lucrative investment vehicle for real estate.

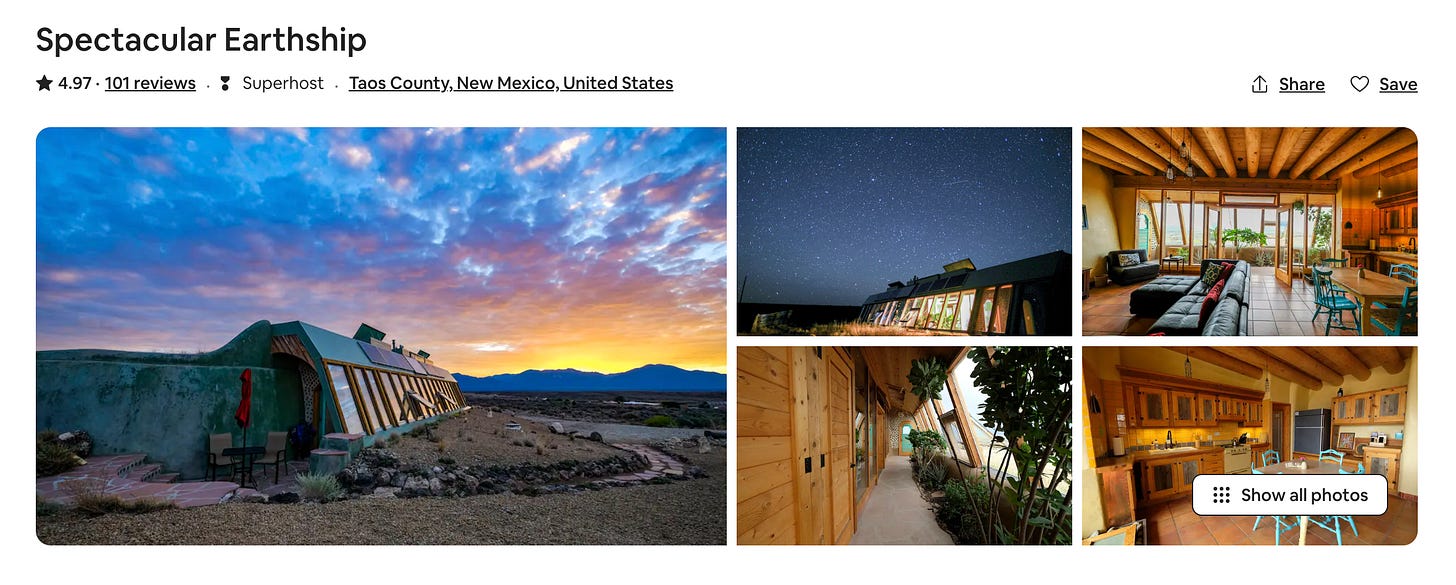

There are two kinds of cash flow effective short term rentals (STRs). One of which is the luxurious kind that Airbnb was built upon. Stay in an Airstream in Joshua or a spaceship on a farm in Europe. Then there is the need of providing a large weekend living space for family gatherings, weddings, etc…

Last month I stayed in a Airbnb for a wedding in a suburban town 20 minutes away from downtown Dallas. Besides the fact that the house clearly had a cockroach infestation, it was generically nice. But we paid around $225/night and the estimated monthly mortgage including property taxes at a 5% interest rate was just under $2K. So you could ostensibly rent it out for about 10 days a month and be cash flow positive!

These businesses actually work quite well but reach some sort of ROI saturation once enough are in a single area. If you’re building a vacation rental for whatever reason, each additional vacation rental opened up in the space will decrease the revenue opportunity, although Airbnb’s trust networks make for interesting dynamics to navigate for business operations. How much more are you willing to two equal properties but one has a 4.9 average rating vs a 4.7 average rating?

Overall public opinion is that STRs raise issues around building tourist towns versus preserving community. But it will be pretty obvious if your city is actually being affected by STRs (Waikiki) and many cities are proactively working towards capping the number of STRs allowed in any given city, many times without a real basis that STRs are to blame.

Some expert opinions on what’s going on

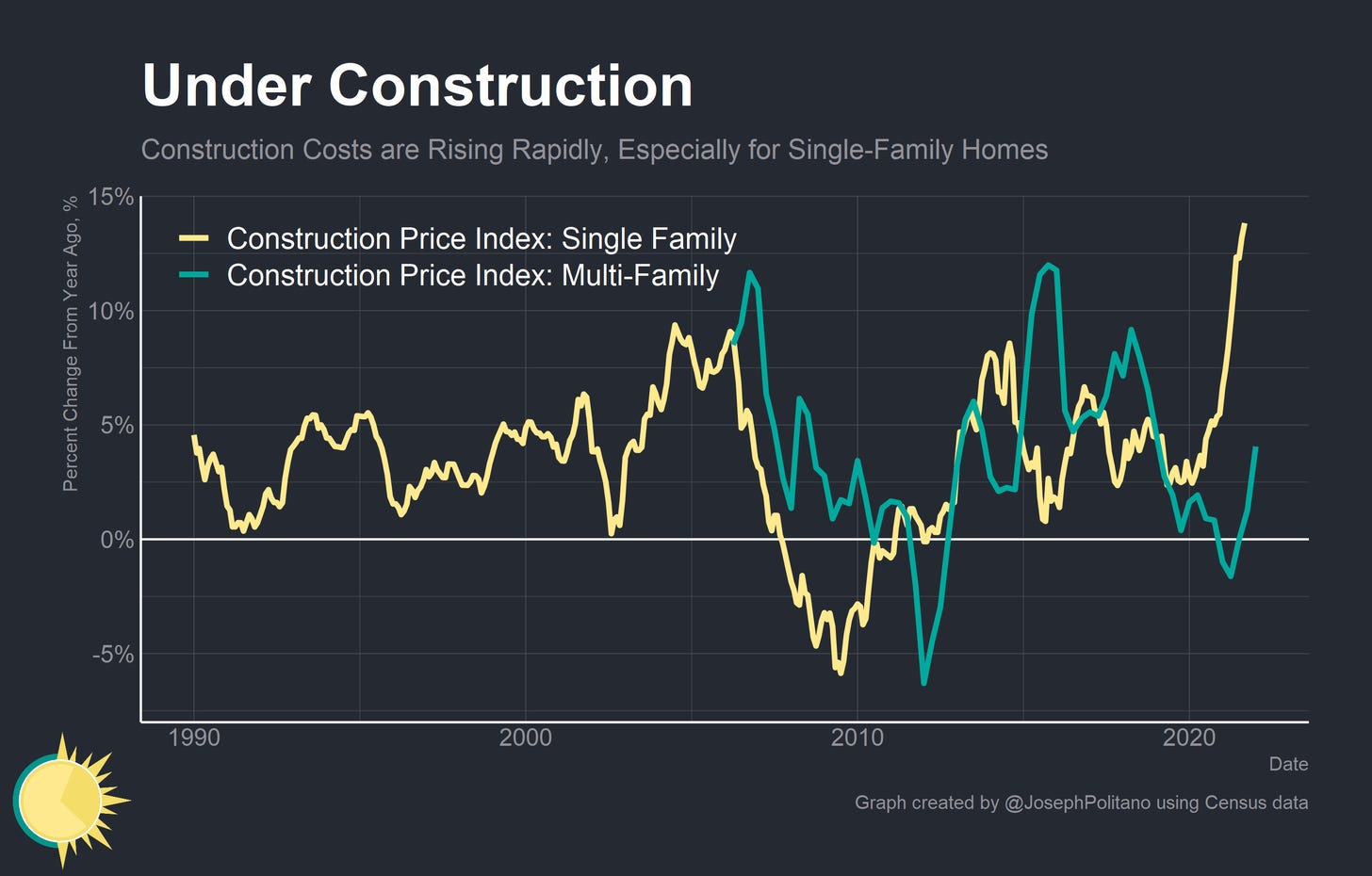

1. Here are two great articles on housing supply.

One use data to causally determine if there actually is a housing shortage and what determining factors in a housing shortage causes unaffordable home prices, and another is analyzing the housing construction data from the past few decades to determine why we haven’t been able to build as much as we’d like.

2. NIMBYism isn’t going away.

Existing homeowners and new homeowners are mostly buying to invest in a community for 30+ years. This mean you don’t want things to happen in your neighborhood that are not beneficial for yourself which could be new construction, less parking spots available, more traffic and congestion, etc…the list goes on and on.

For example - here’s a great article on why housing scarcity is so tough on politics.

This divide between young and old goes some way to explain why housing is such an emotional topic. NIMBYs, largely made up of older property owners, see themselves as the defenders and preservers of the neighborhoods that they moved into, against the developers that would have destroyed them, and high housing prices are a just reward for their years of activism……

….So how do big city NIMBYs reconcile their progressive ideals with their support for regressive housing policies?

The answer is a surprising one: NIMBYs insist that NIMBYism actually isn’t regressive, because housing scarcity isn’t real.

3. There’s not much incentive to sell even as the economy is entering a bear market

Just read this recent Reddit thread about someone who owns two properties, one in the Bay Area and one in Denver and is asking the /r/realestateinvesting community if they should sell it. Many of the answers are pushing towards not selling given the huge incentives towards holding a home that is financed with 3% interest rates.

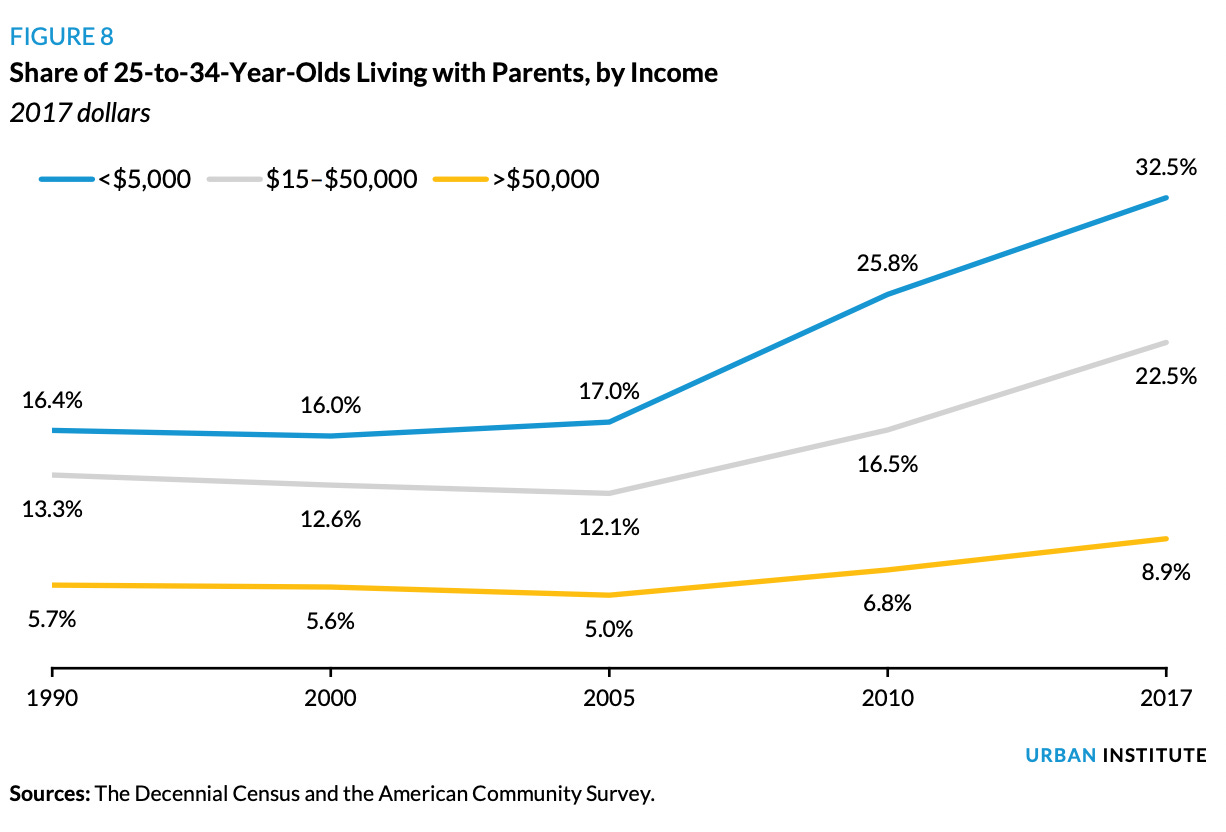

4. Consumer preferences have changed over time.

We now want bigger houses than we wanted 30 years ago. We’ve spent more time at home during and through the pandemic than we ever have before. We are also now more okay with living with our parents or have just been forced into this by the lack of housing:

Conclusion and my closing thoughts

My overall thoughts on the real estate market is that it has almost always felt unaffordable, but I have also lived in and around the Bay Area for the past 8 years. And it’s clear that metros like the Bay Area can skew your perception of how you think about housing.

Additionally I have also reverted to a state where housing will never be an opportunistic investment. Rather buying a primary home to me just needs to happen when I’m in a stage of life where I have committed myself towards raising a family and living somewhere for 5+ years.

This comes from doing an analysis of real estate in other places. Previously there were dreams to be had as a nomad CEO to own properties in multiple locations where I could live in during the nice season months and rent out on Airbnb or what not when wouldn’t be there. And yet while doing the calculation over the past few years - the math just never works out with the homes we want in the places we want to live.

So far the thought of buying a home in a place I want to live (Bay Area) has made me continuously feel like a member of the middle class, even when I take strides towards trying to build more generational wealth. AKA buying a home likely cripples FIRE dreams rather drastically.

But perhaps homeownership is actually MEANT to truly cripple everyone’s personal finances. Disregarding the likely trend of multi-generational home ownership passed down from generations, if the investment in a home means that you’re investing in a time where you will need to support a large enough home for a family, the cost is high because creating your own family is supposed to be tough!

And maybe that’s the right way society should be. In that you’re making a commitment to something larger than you, one that requires sacrifices and dedication towards owning a piece of land that you’d like to maintain. Ideally making the world a better place instead of trashing every Airbnb and treating a place like someone else versus your own.

Overall I have no idea where the real estate market will go. I pray that prices plummet because I do not own real estate myself. But overall I will likely be a homeowner when the time comes and browsing Redfin right now is truly a huge waste of time.

Some ideas around this:

1. It's easy to see the top line number when thinking about selling your house but the actual transaction is hell (Opendoor et al aside). In the Bay Area, expect to eat 5-6% in fees to your Realtor. You may have to eat transfer tax or city mandated repairs (sidewalks, sewer laterals) to the tune of $4-5k each. This is all before staging, marketing etc. plus the pain of movers and finding a short-term place to live while you look for your next house.

2. Property tax estimates on Zillow et al are comically off. They don't account for assessments that have been lobbied at the county level which can be a few thousand extra per year. Given the liberal electorate in the Bay Area, expect any insane tax with zero oversight on the ballot to pass, effectively increasing your property taxes ad infinitum.

On the buy side, it's even more screwed. We all know the sticker price on homes is effectively bullshit. So if the comps tell us roughly what it will go for, now you have 20 other buyers all jockeying to beat one another. Most homes with crazy bidding wars will not assess for anywhere remotely near what they sell for. Lenders will only give you a mortgage up to what a house will assess for. What does this mean for perspective buyers? You better have a lot more cash on hand to cover the spread between your 20% down payment and whatever you bid on your house, or better still, all cash.

Worse still, since most homes in the bay area are sold with non-contingent offers, your 3% earnest money deposit is on the line should you decide to back out of your insane offer. This puts you into a sticky spot. Either come up with the difference in cash, or pay the seller 3% of your offer for wasting their time, further eroding your stack.

The deck is pretty stacked against normal people transacting real estate given the immense friction involved.

The one point I found hard to swallow is, the nimby-ism. It is pretty entrenched in a lot of places, but upzoning is a clear win for property owners, particularly in the Bay Area. If the flats of Oakland got upzoned to 3 and 4 story walk-ups, it would massively increase density (think Brooklyn), have zero effect on the skyline, allow for a boon of ground-floor retail opportunity and give homeowners a chance to dump their homes to a developer at a substantial premium while likely improving affordability in the area writ large. In places like Berkeley though, I think this would be a tough pill to swallow because it makes too much sense. We probably need some legislation to change CEQA to take some tools out of the NIMBY tool belt before we'll see meaningful change here.