Your Retirement Date is Wrong

And my review of Crypto Confidential

Eight years ago, I was 99% sure I would be able to retire at age 43.

This confidence came from a Excel financial model I built as a fresh newly entered into the workforce 22-year old.

In this model - I did a few advanced things. For one - I wanted to set lower and upper bands on my monthly spending budgets. By living with roommates in a cheaper neighborhood in San Francisco, I was spending around $3500 to $4000 every single month. If I was optimizing for saving money - I forecasted I could subsist off of a minimum of $2500/month. If I wanted to ball out, really be just super reckless, I could maybe spend up to $5500/month 😱.

Given these budgeting inputs, I could forecast my future income and figure out how many years it would take to retire / aka FIRE. So using a 7% rate of return and a consistent 10% increase in salary every year, and an adjusted rate of inflation, I computed hitting “the number”, at 43.

When I stumbled upon this spreadsheet last month - I was pleasantly surprised because I was comically wrong.

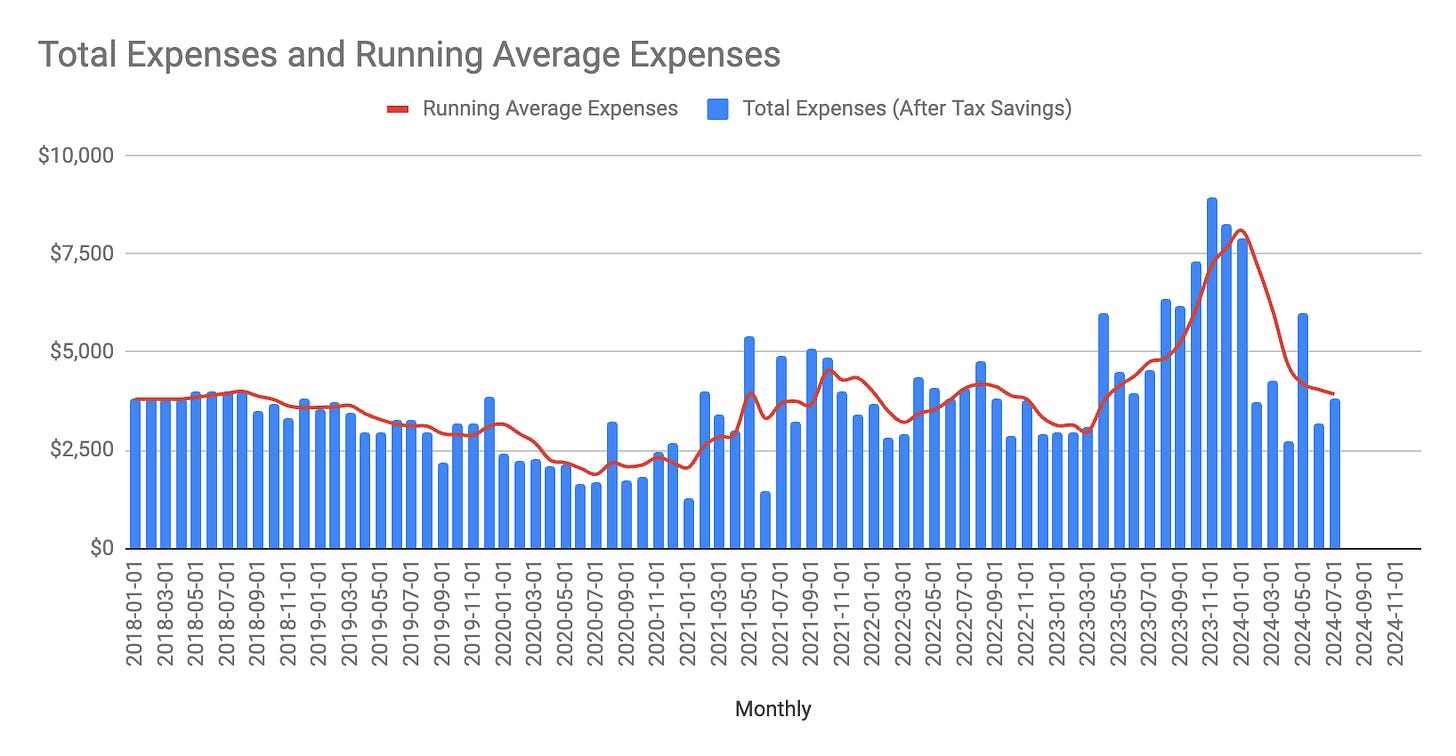

Here’s how I actually spent money over the last 5 years since I started tracking my finances.

When a pandemic that I never could have forecasted hit the world, I was spending maybe $1600/month (that’s including rent!) And then when I spent two months in New York after a surprise break-up, I ended up spending almost $20K that summer alone.

And then there’s your income. Usually your life and income does not model out quitting your job to join a startup, taking a six month sabbatical, or when the world goes crazy and starts valuing crypto shitcoins on the internet.

So the question really is - why did I spend any time at all making personal financial models to begin with? And not only that - why do I continue to try updating it every year?

I suspect, as with most things in life, it’s because I enjoy personal finance*. It gives me a sense of security in an uncertain future. And therefore transforms me into being a hobbyist of making useless financial forecasts that don’t result in anything.

One thing I constantly battle is the understanding that I cannot control the future. Sure I can control my spending, but realistically I’m not going to not make that the priority over life itself. Maybe it gives a practice of discipline from an irrational feeling of security. But when you grow up with some feeling of financial insecurity - nothing will ever feel enough.

And apparently other people do to - otherwise this business Projection Lab which gives the financial independence crowd based on different monte carlo variations of how the stock market index funds will change, wouldn’t exist.

The Crypto Mania Really Was Unbelievable

Crypto Confidential is a memoir of Nat Eliason’s experience in the crypto and NFT industry from 2021 to 2022. Nat starts off with an initial interest in making some money on the side and eventually becomes the main developer and stakeholder in a token that gets valued at billions of dollars at the peak of the mania*.

At it’s core, the book details the arc of the transfer of wealth from those that were “half-in” the mania vs the die-hard followers that were fully invested in tracking new drops, prices, and framing yields. Like myself, if you were just "kind of interested in crypto" but not really fully involved, it was easy to repeatedly lose money as tokens got pumped and dumped (Luna still hurts). And while every new token and NFT drop was a mini ritual game of “don’t get caught holding the bag”, there was also a larger story about how the entire period was a large Ponzi scheme, where if you decided to go all-in on crypto in January 2022, you likely lost lots of money on the larger crash.

The repeated theme throughout the book was how nothing made sense during this period. For example, the author at one point was the sole solidity developer on a project that raised millions of dollars in paper money through a token drop. But he had also just learned solidity programming maybe one week beforehand.

And while most crypto books would focus on the future and grand visions of blockchain, this one took the entire period at face value for what it was. But the conclusion still felt weak because the reader never learns about why BTC, ETH, or blockchain themselves really have true value. There is really nothing in the book that backs that these cryptocurrencies even have lasting value even now except for mindshare. So while there are a lot of arguments that you can make across the different domains for the bull case of ETH and BTC, what I took away from it was that a lot of people participated into a ponzi scheme and the smart ones walked away with more money from the Covid injection and ZIRP period while everyone else was left off worse given inflation.

Lastly the author has founded a successful SEO agency before the book called Growth Machine that does multiples of millions of dollars a year. Yet throughout the book, he talks about how he needs money to afford a house and how his wife and him have a kid coming and it forms the basis for his hero’s journey arc to really dig in deep to learn solidity and the crypto ecosystem. So some disconnect there…..

But Nat’s business looks like it’s doing great and he’s an awesome inspiration for the wanna-be writer and post-business owner in me that realizes that maybe “the money is too good to quit”. So I don’t want to shortchange him too much for following his dream and actually writing his first book.

Nat Eliason changed the name of the token from CRAFT to AURUM and the game behind it was Crytoraiders.gg. And if you finish the book and want to read more about the actual token development and game mechanics that he built - you can read it on Medium.

Things to Share

Related to Crypto Confidential, Nat Eliason shared his tips for writing better ahead of his book launch back in June.

How to Fund Growth (& when not to) by CFO Secrets. I don’t know a better blog right now that is teaching everything I wanted to know in an MBA without actually getting an MBA.

So you wanna de-bog yourself is a funny read with some practical advice on getting unstuck. I’m favoriting it for a re-read that I’m sure I’ll need in the near future.

Tony Soprano and the Jungian Death Mother was a nice recap after finishing the Sopranos.